Mid Oregon FCU: New Mobile Banking & Security Updates - Learn More!

Are you seeking a financial institution that seamlessly blends modern technology with a commitment to personalized service? Mid Oregon Federal Credit Union, a cornerstone of the Bend, Oregon community since 1957, is redefining the banking experience with its cutting-edge mobile and online platforms, all while prioritizing the financial well-being of its members.

In a world increasingly reliant on digital solutions, Mid Oregon Federal Credit Union (FCU) has taken a significant leap forward, investing in a new mobile and online banking system. This strategic move is designed to enhance the member service experience, providing greater convenience, security, and control over personal finances. The system's widespread adoption in its first week, with over 75 percent of online banking users embracing the new platform, underscores the growing preference for remote money management among members.

| Overview: | Mid Oregon Federal Credit Union |

| Founded: | 1957 |

| Headquarters: | Bend, Oregon |

| Assets: | Over $728.3 million |

| Members: | Over 47,300 |

| Branches: | 1 |

| ATMs: | 7 |

| Key Services: | Checking and Savings Accounts, Loans, Mobile Banking, Online Banking |

| Core Values: | Member Focus, Community Engagement, Financial Security |

| Website: | Mid Oregon Federal Credit Union Official Website |

The transition to this new digital banking platform is designed to be smooth and efficient. Existing online banking users can convert their login with ease, a process estimated to take only a few minutes. The system boasts enhanced security features, ensuring the safety of members' financial information. This commitment to security is further demonstrated through Mid Oregon's partnership with "Stickley on Security," providing members with valuable information and resources to protect their identity and financial data. This initiative reflects the credit union's dedication to fostering safe financial habits within its membership and the broader community.

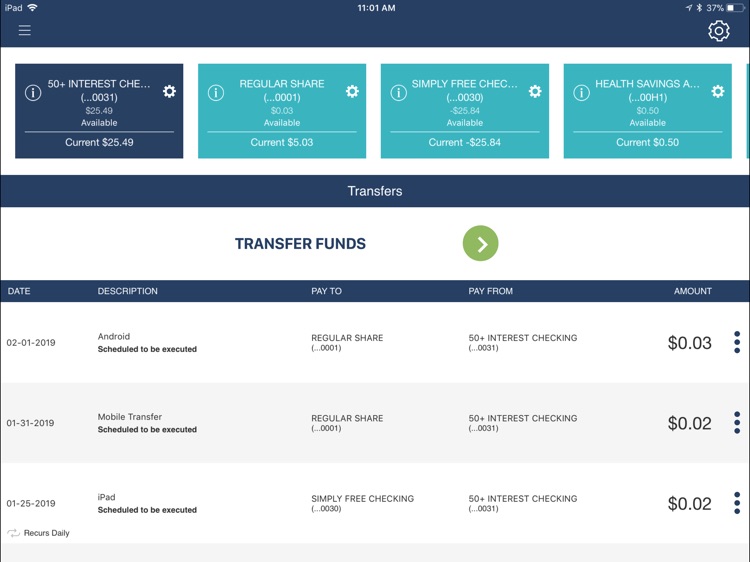

For those seeking effortless access to their funds, the Mid Oregon app provides a convenient solution. Members can deposit checks in seconds from anywhere using their mobile devices. The app also offers a range of other features, including the ability to check account balances, transfer funds, turn debit cards on/off, pay bills, locate ATMs or branches, view account activity, and contact the credit union directly. The mobile app is free and provides secure access to accounts anytime, anywhere.

Mid Oregon FCU's commitment to providing its members with convenient and secure banking options extends beyond its mobile app. The credit union offers services compatible with Apple Pay and Samsung Pay, allowing members to easily add their Mid Oregon cards to mobile wallets for seamless spending. This integration of modern payment solutions reflects Mid Oregon's dedication to meeting the evolving needs of its members.

The credit union's commitment to community involvement and providing comprehensive financial solutions extends to other services. Dina Bliss, a mortgage loan officer at Mid Oregon Home Loans, is available to assist individuals with their home financing needs. Whether it's refinancing an existing loan or purchasing a new home, members can benefit from the guidance of an experienced local lending expert from application through closing.

Mid Oregon FCU is more than just a financial institution; it's a community partner. The credit union's physical presence in Bend, Oregon, with its single branch and network of seven ATMs, reinforces its commitment to serving the local community. The credit unions ability to serve its members is a testament to its longevity and dedication to their financial success.

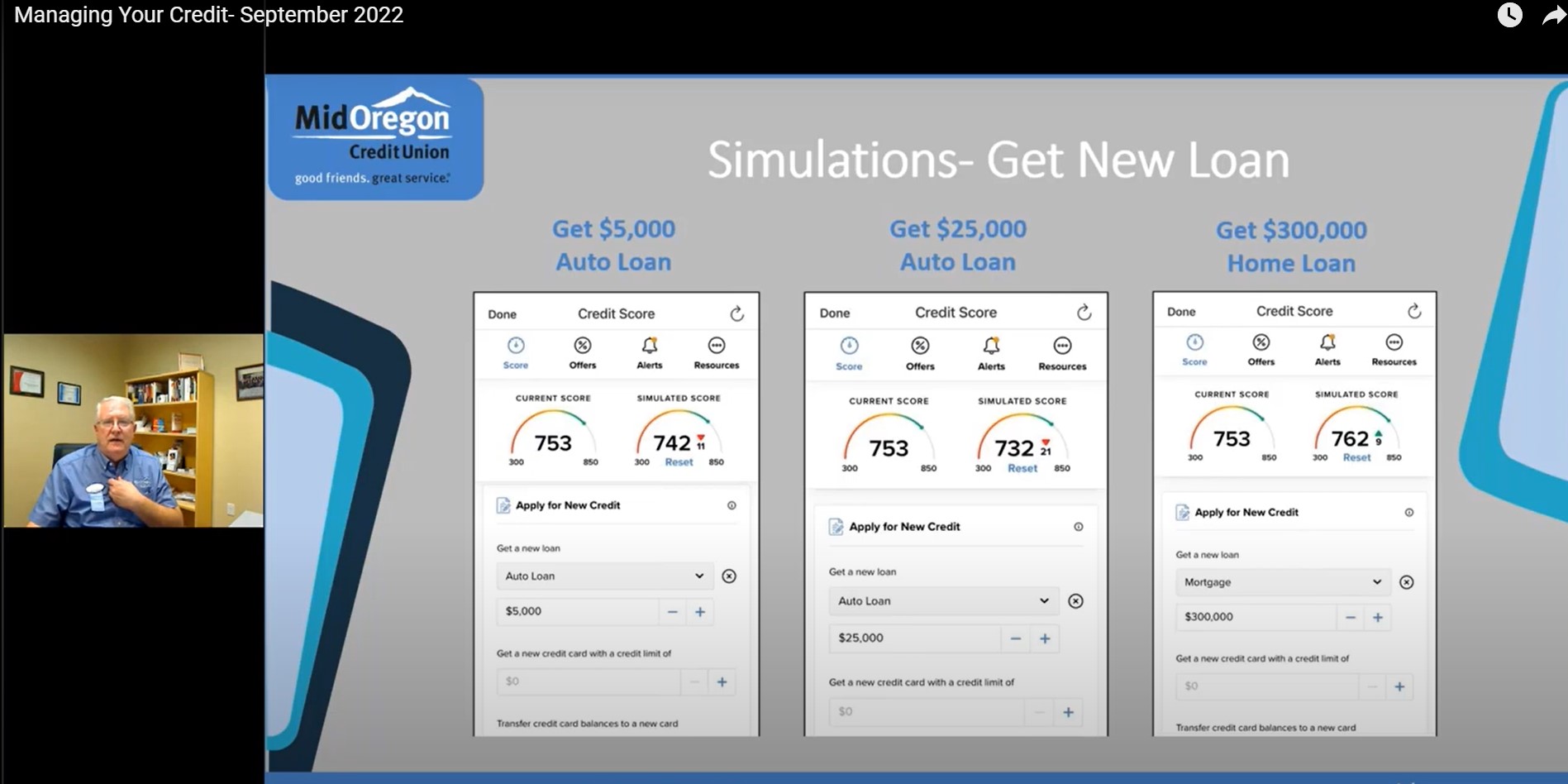

Beyond banking services, Mid Oregon FCU is deeply involved in promoting financial literacy and security among its members. Partnering with "Stickley on Security" and providing resources on identity protection and safe financial habits underscores the credit union's dedication to protecting its members from fraud and financial crime. Members are encouraged to stay vigilant and to utilize the resources provided to safeguard their financial well-being.

For those seeking to open a new checking account, Mid Oregon FCU offers an enticing incentive. By opening a new account before a specified date, members are entered for a chance to win a prize. This initiative, coupled with the convenience of digital banking and the security measures in place, makes Mid Oregon a compelling choice for individuals seeking a reliable and member-focused financial institution.

In the event of a lost or stolen debit card, Mid Oregon FCU provides prompt assistance. Members can easily report the issue and receive guidance to ensure the security of their funds. This responsiveness demonstrates the credit union's commitment to providing exceptional customer service and protecting its members' financial assets.

In the heart of Central Oregon, Dusty Auto Detailing, a premiere detailing service, provides exceptional care for vehicles, boats, and RVs. Serving the Bend, Oregon, and surrounding areas, Dusty Auto Detailing offers professional cleaning, restoration, and maintenance services. Contacting them is easy; simply schedule your detailing service and experience the quality and attention to detail that sets them apart.

Furthermore, members can leverage their smartphones to manage their finances through Mid Oregon FCU's secure mobile banking services. These services encompass paying bills, transferring funds, and more. Access to these services extends to all service areas, highlighting the credit union's commitment to accessibility.

Mid Oregon Federal Credit Union offers checking accounts, often referred to as share draft accounts, which provide convenient access to funds via debit cards. These accounts are designed to simplify daily transactions and provide members with financial flexibility. Come home to Mid Oregon Credit Union, a place where financial security meets community support.

To further enhance digital security, Mid Oregon FCU recommends that members take advantage of multi-factor authentication. Popular authentication apps such as Duo Mobile, Google/Microsoft Authenticator, and Authy can be used to secure accounts, providing an extra layer of protection. Visiting the device's app store allows members to choose the best option and safeguard their financial information.

Mid Oregon Federal Credit Union, established in 1957, continues to thrive in Bend, Oregon, serving over 47,300 loyal members with over $728.3 million in assets. The credit union's commitment to its members, community engagement, and technological advancements establishes it as a prominent player in the financial services industry.