TIAA Brokerage Account: Fees, Features & How To Get Started

Are you ready to navigate the complex world of investments with confidence and clarity? Understanding the nuances of brokerage accounts, especially within the context of financial institutions like TIAA, is crucial for making informed decisions that align with your financial goals.

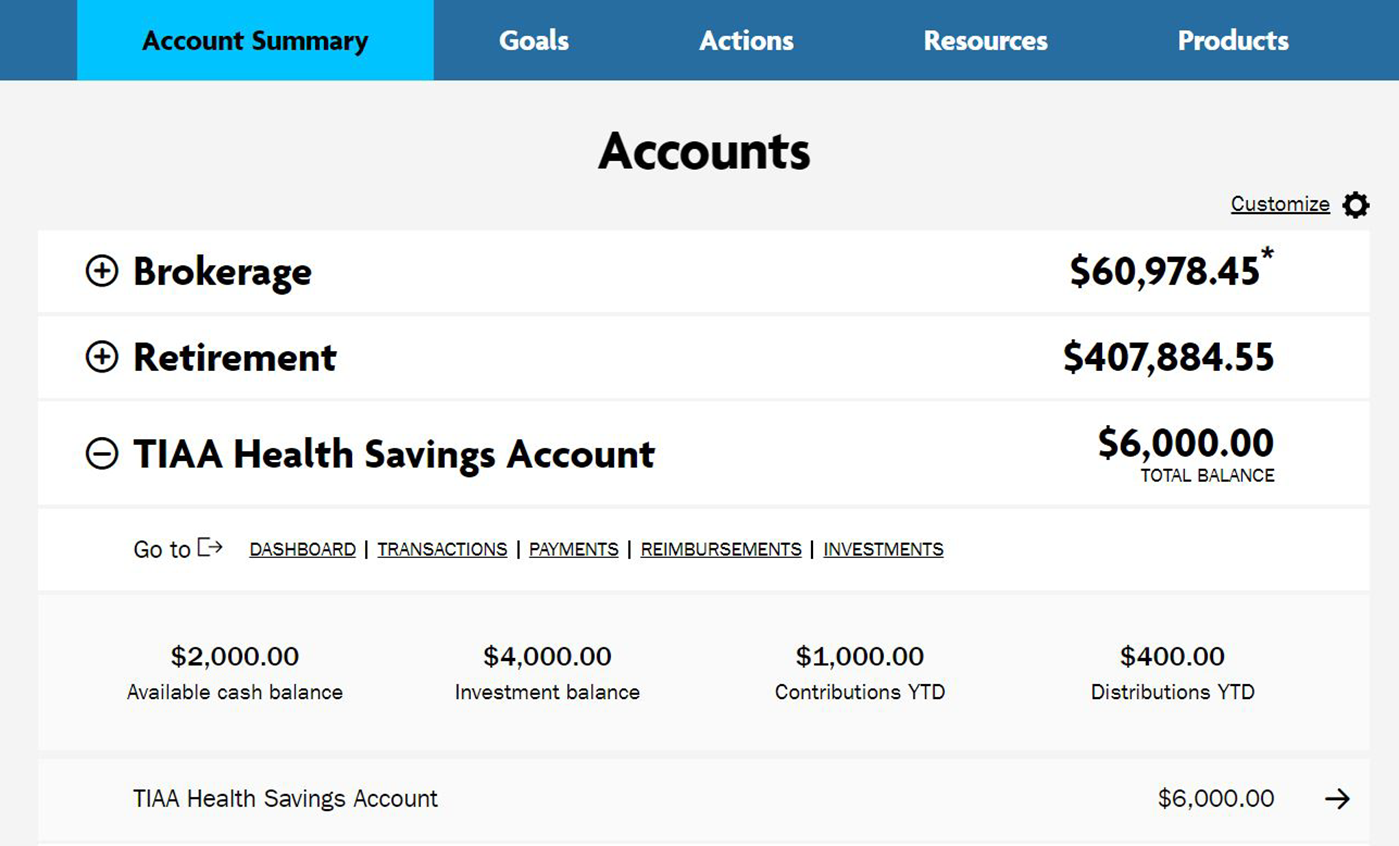

A TIAA brokerage account, accessible with a minimum balance of $10,000 and subject to a yearly fee, offers a compelling suite of features. These include the convenience of checks, bill pay capabilities, and a debit card, effectively transforming the account into a comprehensive cash solutions platform. However, its important to note that custodial accounts do not qualify for the debit card feature. TIAA is continually enhancing its services, now providing a consolidated view of your entire TIAA portfolio, coupled with a detailed summary of payments received over the past two years, providing a more holistic financial overview.

Before diving into a TIAA investment account, a thorough understanding of both its advantages and drawbacks is essential. The platform provides cash sweep product options, which may accumulate and pay interest on the cash balance within your account. Any interest earned is accrued daily and disbursed monthly. Interest rates are available within our brokerage interest rates disclosure online.

However, prospective investors should be aware of some limitations. The TIAA platform's trading tools are considered basic and lack advanced features. The website's interface is relatively simple and does not offer sophisticated tools. The order ticket is limited, supporting only four order types and lacking additional functionalities. TIAA cannot guarantee the accuracy of information and will send an updated prospectus if changes are made by the investment companies regarding the funds in your account. Furthermore, mutual funds are generally considered a longer-term investment strategy. The TIAA group of companies emphasizes that it does not provide legal or tax advice, and customers are encouraged to consult with their tax or legal advisors for personalized guidance. It's also essential to understand that the Securities Investor Protection Corporation (SIPC) only protects customers' securities and cash held in brokerage accounts.

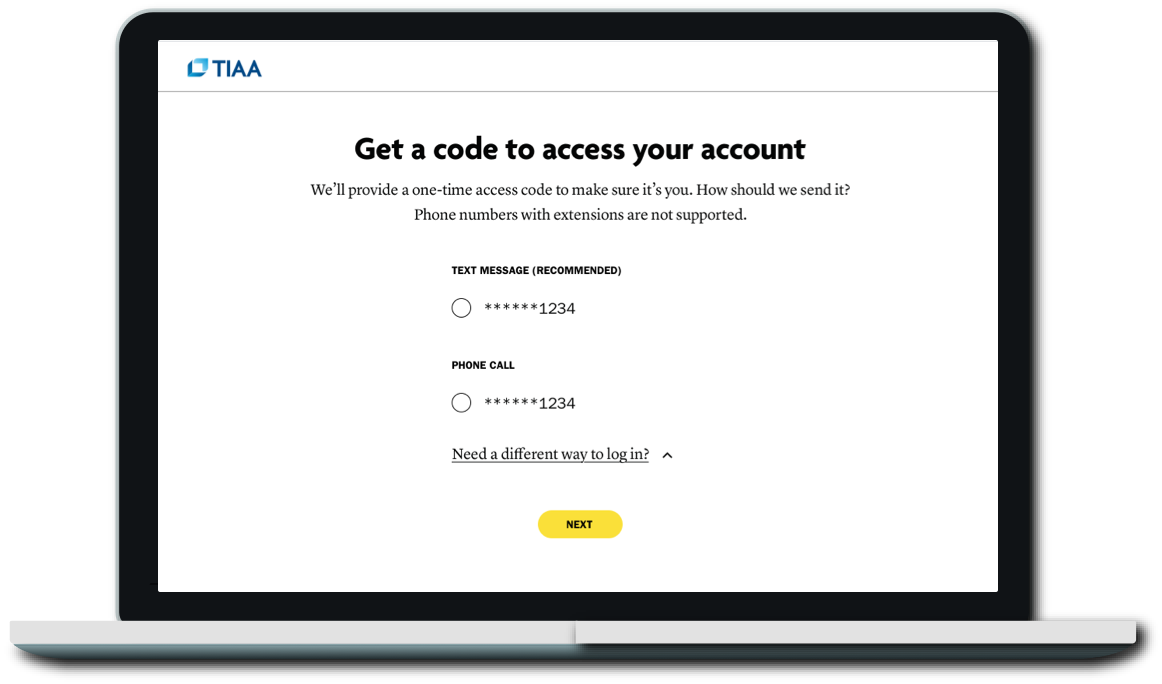

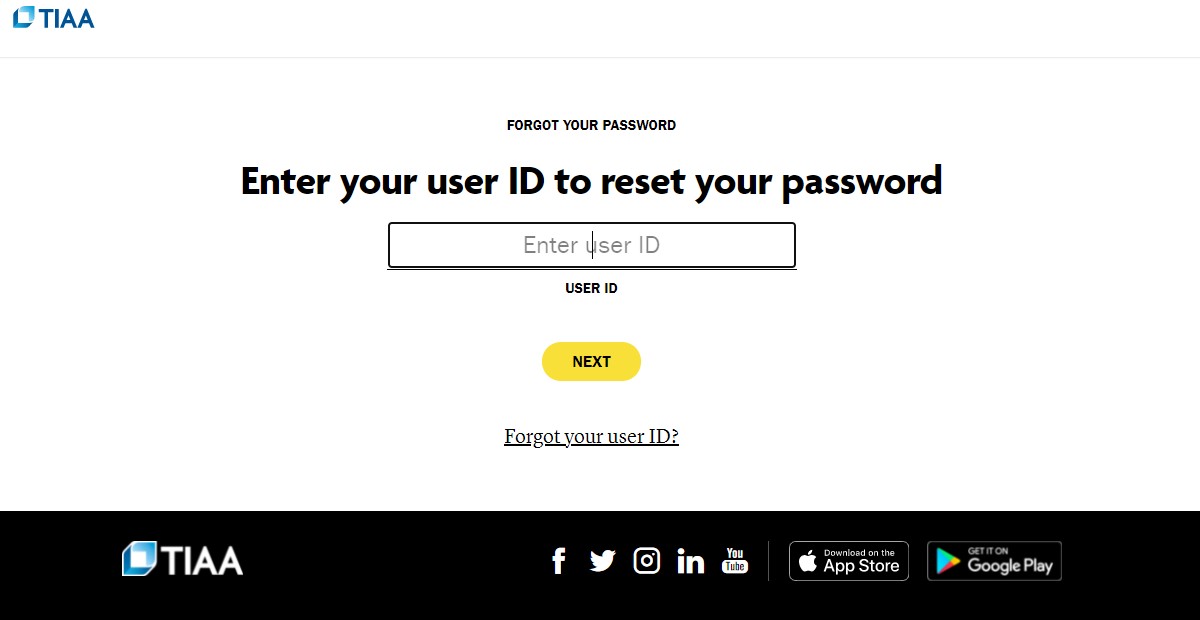

Opening a new account involves reviewing a comprehensive new account kit. This kit contains all necessary forms, disclosures, supplementary forms, and agreements. The TIAA Form CRS is the first document you'll encounter when opening the kit. For those who prefer a more hands-off approach, a managed account may be beneficial, particularly if you find researching and investing overwhelming or lack confidence in your financial knowledge. Brokerage accounts are managed by Pershing, LLC, a subsidiary of The Bank of New York Mellon Corporation, and are members of FINRA, NYSE, and SIPC. When it comes to account monitoring, the question arises: Will your brokerage account be monitored by anyone besides you? TIAA.org provides tools that allow individuals to compare investment options and review available resources.

To transfer your account from another firm to your TIAA brokerage account, you can download and complete the incoming transfer form. If you have any questions or need to send information, you can use the following addresses: TIAA Brokerage PO Box 1280 Charlotte, NC 28201 or TIAA Brokerage 8500 Andrew Carnegie Charlotte, NC 28262. For account registration, TIAA Brokerage Account Information requests the name(s) on the account, and provides space for the title or registration of your TIAA brokerage account. For new account applications, please leave the account number blank. You can assess fees and costs by examining the TIAA CREF fees schedule, commissions, brokerage stock trading costs, IRA charges, online investing account pricing, and cash sweep rates. With TIAA, you can establish a brokerage account and manage an investment portfolio. If you need to make edits, you can change the cash balance to zero and/or change the account type to 401(k)/403(b). If there's a technical issue, verify the ticker symbol and/or price, and they may be incorrect. Also, you can delete the account and download the Quicken (.qfx) file again.